Table of Contents

- Introduction

- What is Driving Negative Sentiment?

- Melbourne’s Sprawling Suburbs

- Melbourne is Cheap Relative to Other Cities

- The Past 3 to 5 Years: A Slow Phase for Melbourne

- You Fund Retirement in Dollars, Not Percentages

- What Will You Think in 2034?

- Conclusion

- Key Takeaways

Introduction

Melbourne’s property market has faced significant challenges in recent years, including rising property taxes, increased state debt, and stricter regulations. These factors have dampened investor sentiment and driven up costs. However, despite these hurdles, Melbourne is well-positioned to achieve the highest dollar-value capital growth over the next decade. This blog explores why Melbourne’s long-term fundamentals make it an attractive investment opportunity.

What is Driving Negative Sentiment?

Investor sentiment towards Melbourne’s property market has deteriorated due to stricter tenancy laws, increased property taxes, and concerns about Victoria’s escalating debt. Recent regulatory changes, such as mandatory property improvements, have increased compliance costs for landlords. Additionally, new taxes like the COVID-19 Debt Temporary Land Tax Surcharge and the Vacant Residential Land Tax have reduced profit margins for property investors.

Victoria’s state debt, currently estimated at around $126 billion, adds to investor concerns. Rating agencies have warned that this debt could nearly double by 2027, exacerbating fiscal pressures and heightening investor apprehensions. Despite these issues, the fundamentals of supply and demand will eventually outweigh these short-term challenges, setting the stage for a market rebound.

Melbourne’s Sprawling Suburbs

Unlike Sydney, which is constrained by natural boundaries, Melbourne has ample space for expansion. This geographical advantage allows Melbourne to spread out its suburbs, reducing the disparity in property prices between inner and outer areas.

However, Melbourne’s population is expected to surpass Sydney’s in the near future, which could strain infrastructure development. Increased congestion and longer commute times in outer suburbs may enhance the attractiveness of blue-chip suburbs. As infrastructure struggles to keep pace with population growth, properties in established, high-demand areas are likely to benefit from this trend

Melbourne is Cheap Relative to Other Cities

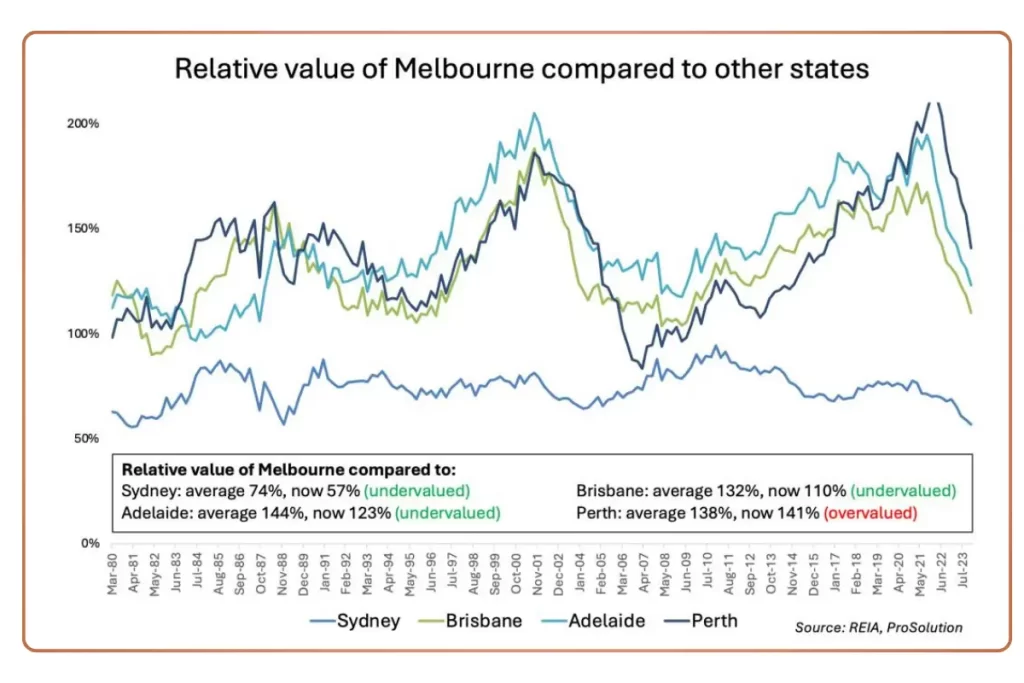

Comparing Melbourne’s property market to other major cities reveals that Melbourne currently offers significant value. Over the past five years, Melbourne’s property prices have underperformed relative to cities like Sydney, Brisbane, and Perth.

Currently, Melbourne’s median house price is about 57% of Sydney’s median price, the lowest ratio since 1981. This comparative analysis indicates that Melbourne’s property prices are at an unusually low point relative to Sydney. Given the principle of mean reversion in market cycles, it is reasonable to expect a rebound in Melbourne’s property prices, making it a compelling investment opportunity.

The Past 3 to 5 Years: A Slow Phase for Melbourne

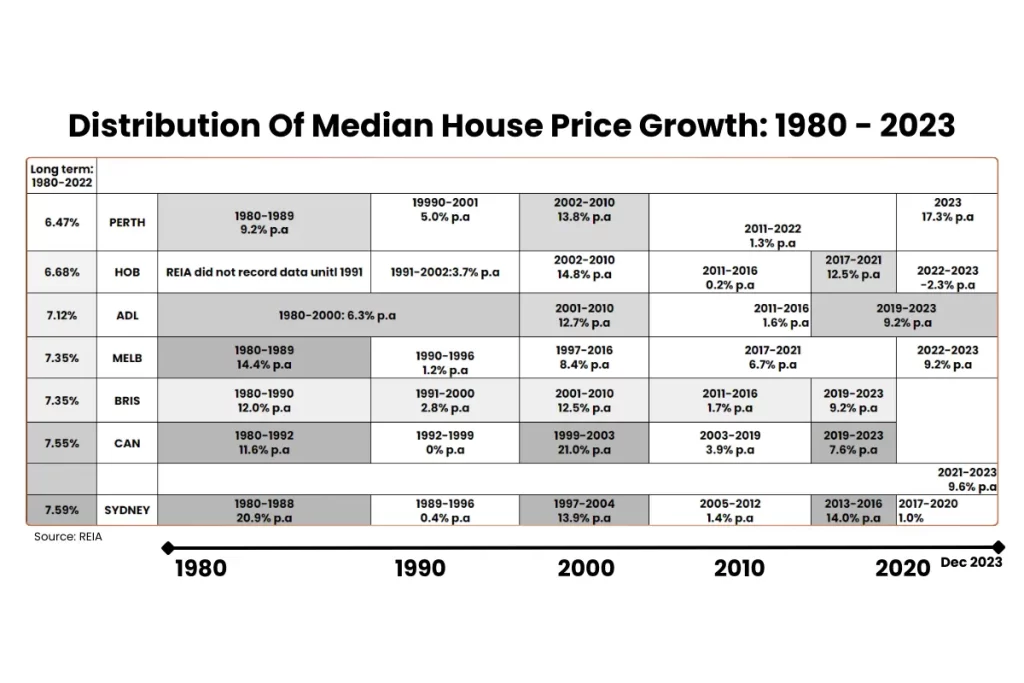

While cities like Brisbane, Adelaide, and Sydney have experienced robust growth, Melbourne has lagged behind.

This underperformance is highlighted by recent data showing that Melbourne’s property market has been relatively flat compared to its counterparts.

Property markets move in cycles, with periods of stagnation typically followed by growth phases. Melbourne’s current slow phase suggests that the market is due for a growth phase. The historical trend of market correction indicates that Melbourne is likely to deliver above-average growth over the next decade, driven by natural market cycles.

You Fund Retirement in Dollars, Not Percentages

While Perth may offer higher percentage growth in the short term, Melbourne’s higher initial property values suggest it will deliver more substantial absolute dollar-value growth. Investors focusing on long-term, dollar-based returns will likely find Melbourne to be a more lucrative opportunity.

As of December 2023, Melbourne’s median house price was $909,000, compared to Perth’s $645,000. When planning for retirement or evaluating investment returns, the absolute dollar value of returns is crucial. Melbourne’s higher starting property values imply greater potential for substantial dollar-based growth, despite potentially lower percentage gains compared to other cities.

What Will You Think in 2034?

Looking ahead to 2034, current property prices in Melbourne’s blue-chip suburbs will likely seem like a bargain. Negative sentiment may have peaked, and historically, market lows often align with periods of maximum pessimism.

Given Melbourne’s balanced property market, with a level of demand from buyers and sellers, acquiring property at fair market value is more feasible now compared to more buoyant markets. Investing in high-quality properties today, before sentiment shifts and prices rise, presents a strategic advantage. While short-term returns may be modest, investing in Melbourne’s property market now could yield significant rewards over the next decade.

Conclusion

Despite the current challenges facing Melbourne’s property market, its long-term prospects for capital growth remain exceptionally promising. The city’s relative value compared to Sydney and other capitals, combined with population growth and market cycles, positions Melbourne as one of the best investment opportunities for the next decade. By capitalising on Melbourne’s current market conditions and preparing for its eventual recovery, investors can potentially secure substantial returns in the years to come.

At InvestPlus, we provide diverse products including house and land packages throughout Australia, strategically positioned in locations recognised for their Strong growth prospects. By collaborating with trusted developers and builders, we ensure the quality and value of your investment. For further information on securing your real estate investment through strategic planning, please contact us using the details provided below.

Key Takeaways

– Recent tax and regulatory changes have created challenges for property investors in Melbourne, but these are reflected in current prices.

– Melbourne’s population growth and space for expansion make it a strong contender for long-term growth.

– The city’s property prices are currently low relative to Sydney, presenting a prime investment opportunity.

– Over the next decade, Melbourne is likely to deliver the highest dollar-value capital growth.