Summary

Recent data reveals that the median dwelling prices in Adelaide and Perth are approaching those of Melbourne, a trend not seen in the last 15 years. This development opens a significant discussion for investors considering where to place their money in the Australian property market.

Table of Contents

- Summary

- Historical Insights

- The Influence of COVID-19

- Melbourne’s Counter-Cyclical Investment Appeal

- Recent Market Dynamics

- A Window of Opportunity

- Conclusion

Historical Insights

Fifteen years ago, in April 2009, the median dwelling price in Adelaide was comparable to Melbourne, sitting around AUD 368,969. In August 2011 and January 2015, Perth’s prices also aligned closely with Melbourne’s. The mid-2000s mining boom briefly allowed Perth to eclipse Melbourne by 32.1% in 2006. However, by 2015, Melbourne had regained its footing, surpassing Perth again.

Fast forward to the present, and we see Adelaide’s median dwelling price has reached AUD 734,173, reflecting a 1.4% increase. Perth is not far behind, with its median surpassing AUD 700,000 at AUD 703,502, marking a 1.9% rise. Meanwhile, Melbourne’s median dwelling price has remained stable at AUD 778,892. This stability raises the possibility that Adelaide’s median could soon surpass Melbourne’s, with Perth not far behind either.

The Influence of COVID-19

The onset of the COVID-19 pandemic brought significant changes to the Australian property landscape. The stringent restrictions in Melbourne led to a mass exodus from the city, resulting in a substantial reduction in its property premium over both Perth and Adelaide. What was once a 40-50% price difference shrank to just 10.7% over Perth and 6.1% over Adelaide.

Currently, a shortage of housing stock and increased immigration—particularly to Perth—are driving up prices in these cities. In contrast, Melbourne’s abundant supply, especially of apartments, has kept its dwelling prices more stable.

Melbourne’s Counter-Cyclical Investment Appeal

Despite its stable prices, Melbourne’s property market presents a unique investment opportunity, particularly in a counter-cyclical context. The city’s economic resilience, diverse population, and high quality of life contribute to its strong fundamentals. Interestingly, Melbourne has emerged as Australia’s biotech capital, benefiting from strong institutional support and robust research and development infrastructure.

While some investors may hesitate to enter the Melbourne market, believing the timing is wrong, history suggests that the smartest investors have already taken positions. Those who were astute enough to invest 2-3 years ago are now focusing on areas in the early growth phase of their property cycle.

Recent Market Dynamics

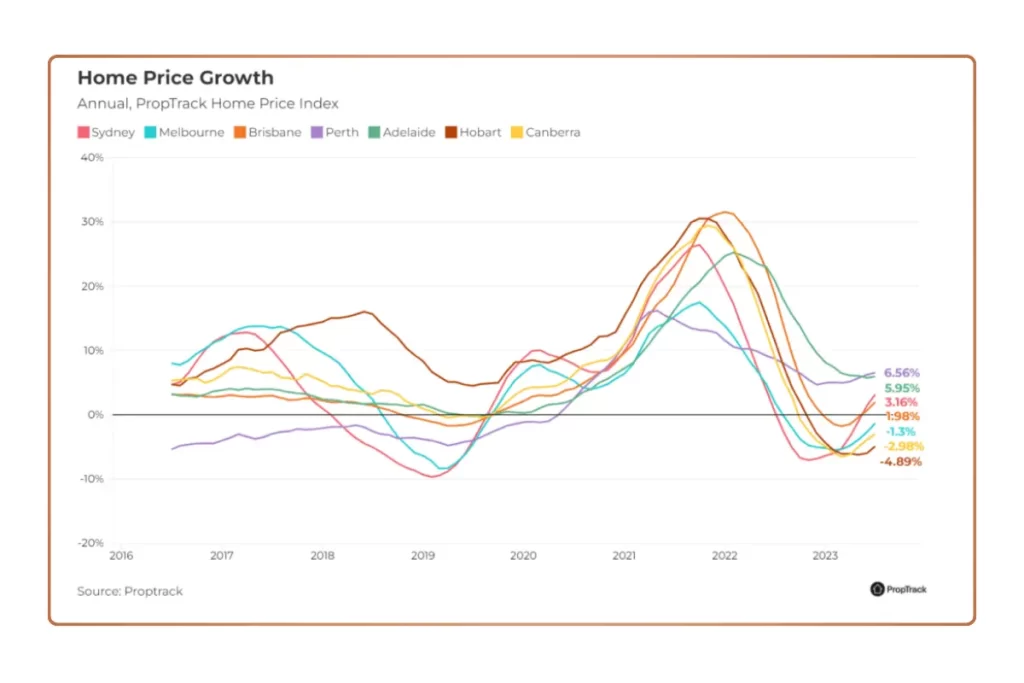

The COVID-19 pandemic, alongside strict lockdowns, adversely affected Melbourne’s real estate market, which saw significant price growth in 2020 and 2021, followed by a decline of 7.9% from its peak in March 2022 to a low in January 2023.

Since then, the Melbourne property market has shown signs of recovery, albeit at a slower pace than other capital cities. Nonetheless, the fundamentals remain strong. Melbourne boasts a robust economy, a consistently growing population, and ongoing infrastructure development—factors that make it a compelling long-term investment destination.

Recent forecasts from Oxford Economics predict a promising outlook for Melbourne’s property market over the next three years, estimating a 21% increase in the median house price and a 20% rise for apartments.

A Window of Opportunity

The current phase of relative price stability in Melbourne presents a unique opportunity for savvy investors. This is a crucial time to enter the market, especially with the expectation of future growth as Melbourne’s housing market recovers.

It’s not uncommon for investors to hesitate, often waiting until prices surge by 15-20% or even more. However, the most strategic investors look for properties that are positioned in the early stages of their growth cycles.

Investing in the right locations within Melbourne can yield significant benefits for those with a long-term vision. Smart investors understand that timing the market is less important than finding properties with strong fundamentals and potential for growth.

Conclusion

The landscape of the Australian property market is changing, with Adelaide and Perth closing the gap on Melbourne’s prices. This development highlights the importance of careful market analysis and informed decision-making for investors. While some may see the current environment as a deterrent, others can view it as a gateway to long-term gains.

Melbourne remains a city of opportunity, combining affordability, stability, and growth potential. As the property market begins to recover, investors who focus on the right areas in Melbourne may find themselves well-positioned to capitalise on future growth, reinforcing the notion that strategic planning and timely action can lead to fruitful investment outcomes.

At InvestPlus, we provide diverse products including house and land packages throughout Australia, strategically positioned in locations recognised for their Strong growth prospects. By collaborating with trusted developers and builders, we ensure the quality and value of your investment. For further information on securing your real estate investment through strategic planning, please contact us using the details provided below.