Co-living has emerged as a compelling investment option for savvy investors looking to tap into sustainable rental income and future-proof their portfolios. In the shifting landscape of property investment, traditional models like single-family homes or apartments are being complemented by new forms of shared living arrangements, appealing to modern tenants’ lifestyles. This blog explores why co-living is fast becoming a preferred investment strategy and why it holds promise for today’s investors.

Table of Contents

- Introduction

- What is Co-Living?

- The Rise of Co-Living: A Response to Urban Challenges

- Advantages of Co-Living Homes

- Co-Living vs. Rooming Houses

- Exit Strategy for Co-Living Investments

- Key Takeaways

- Conclusion: Why Co-Living Investments Are Here to Stay

Introduction

As property markets evolve, so do tenant needs and the types of investments that yield the best returns. Investors are increasingly seeking new ways to maximise rental income, reduce vacancy rates, and tap into the growing demand for flexible housing. Co-living has emerged as a solution to meet these needs. But what exactly makes co-living so attractive, and why are investors flocking to this trend?

What is Co-Living?

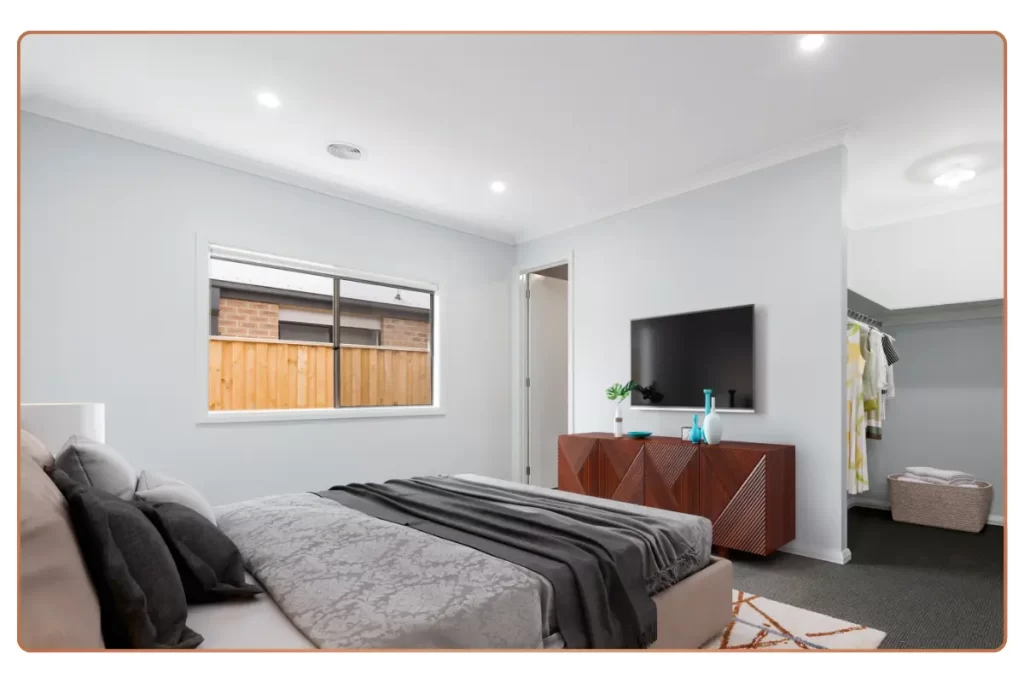

Co-living is a modern housing arrangement where multiple tenants share communal spaces such as kitchens and living rooms while maintaining private bedrooms. Purpose-built co-living homes enhance comfort and privacy by providing individual bathrooms and other upgraded features. This arrangement allows investors to rent rooms individually, significantly boosting rental income and occupancy rates.

The Rise of Co-Living: A Response to Urban Challenges

The surge in co-living’s popularity is largely driven by urbanisation and rising property prices in major cities. Young professionals, students, and digital nomads seek affordable and flexible living spaces, often in high-demand urban areas. Co-living provides tenants with lower costs and a sense of community, meeting the needs of today’s lifestyle-driven renters. For investors, the trend caters to an underserved market segment, with high demand, low vacancy rates, and long-term rental stability.

Advantages of Co-Living Homes

Co-living homes offer distinct advantages over traditional rental properties. Key benefits include:

- High Rental Yield: Renting out individual rooms generates higher income than traditional single-family rentals. Properties can earn up to 80% more, with gross weekly earnings ranging from $900 to $1,200 for 3-4 bedrooms.

- Larger Rental Market: Co-living homes attract single tenants and young couples, who represent 76% of rental accommodation seekers. These homes are well-suited to this demographic, meeting their demand for flexibility and affordability.

- Higher Occupancy and Lower Vacancy Rates: Co-living properties often enjoy higher occupancy due to their appeal to a broad demographic in high-demand areas, maintaining steady income flow.

- Adaptability: Co-living homes can easily convert back to single-family homes or be sold to investors or owner-occupiers. This adaptability appeals to a broader buyer base, including investors, families, and self-managed super funds.

- Professional Management: Specialised property managers handle individual room rentals, ensuring smooth operations and tenant satisfaction.

Co-Living vs. Rooming Houses

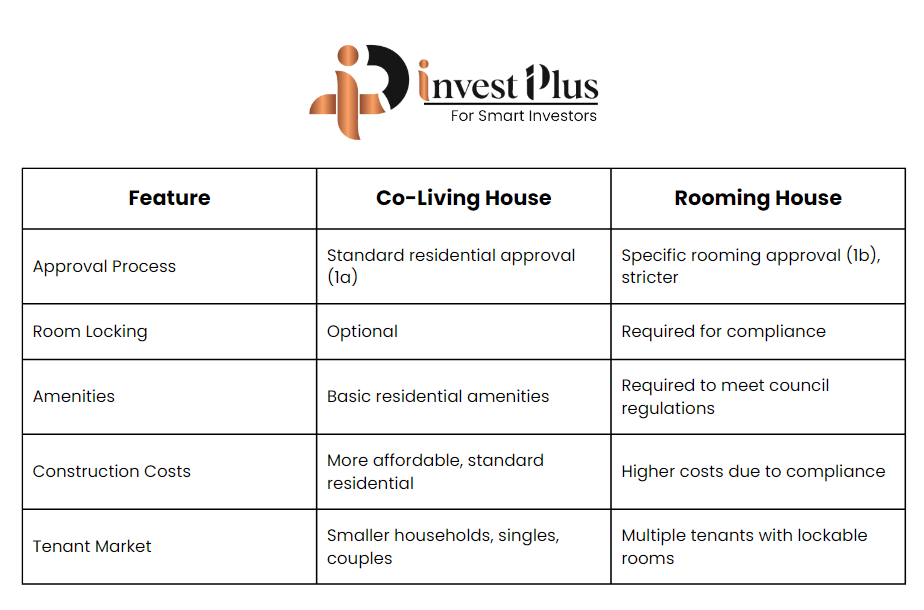

Although similar, co-living homes and rooming houses differ significantly in terms of design, approval, and tenant experience:

These distinctions make co-living homes more flexible, lower-cost investments, appealing to a wider market segment, while rooming houses cater to higher turnover, lower-income renters and require additional regulatory compliance.

Exit Strategy for Co-Living Investments

One of co-living’s strengths is the variety of exit strategies it offers, making it a low-risk investment with broad market appeal. Options include:

- Sale to Investors or Self-Managed Super Funds: The property can continue as a co-living home, providing ongoing rental income.

- Sale to Owner-Occupiers: Co-living homes are designed to look like traditional family homes, enabling a seamless transition for family buyers.

- Sale to Multi-Generational Families: With multiple master suites, co-living homes are ideal for multi-generational living, increasing their market appeal.

These options provide flexibility, enabling investors to capitalise on the co-living model’s appeal in both the rental and resale markets.

Key Takeaways

For smart investors, co-living presents a sustainable rental income model with substantial financial benefits:

- High-Income Potential: Co-living homes can generate 80% more income than standard rentals, with potential weekly earnings of $900 to $1,200 from 3-4 bedrooms.

- Appealing to a Growing Market: As young professionals and students increasingly seek affordable, flexible living, co-living caters directly to this expanding demographic.

- High Occupancy and Low Vacancy Rates: Co-living properties are less prone to vacancies due to their broader market appeal, ensuring consistent rental income.

- Affordable and Prime Locations: Often located in central areas with access to public transport, education, and employment, co-living homes attract long-term tenants seeking convenience and community.

- Future Market Demand: With a forecasted 56% increase in co-living or group households by 2041, the co-living model is poised for long-term demand.

Conclusion: Why Co-Living Investments Are Here to Stay

Co-living represents a forward-thinking investment approach that aligns with modern urban living trends. It’s resilient in the face of fluctuating property markets and provides high rental yields, lower vacancy risks, and growing tenant demand, making it an attractive long-term investment. While co-living properties require active management and regulatory awareness, the rewards outweigh these challenges.

In a world where property markets are constantly shifting, co-living offers a modern, adaptable option that meets tenants’ needs while providing investors with sustainable rental income. It’s no wonder that more investors are turning to co-living as the next big opportunity in real estate investment.

At InvestPlus, we provide diverse products including house and land packages throughout Australia, strategically positioned in locations recognised for their Strong growth prospects. By collaborating with trusted developers and builders, we ensure the quality and value of your investment. For further information on securing your real estate investment through strategic planning, please contact us using the details provided below.